levels, and/or if more than 730 total NROs occur over the performance period (10% weight). The committee’s policy has generally beenmaximum payout under RCF Dollars metric is 270% and the maximum payout under total NROs metric is 30%. If the level of performance falls between the levels in the table, the payout percentage will be determined using linear interpolation. To help ensure that performance goals drive acceptable returns to make equity compensation awards to officers only onshareholders, the 2023 PSUs contain a provision capping the payout at 100% of target if the company’s 3-year relative TSR is below the 25th percentile of the S&P 500 constituent companies.

2023 SOSARs

The NEOs received an annual basis, within five business days followinggrant of SOSARs on February 9, 2023. These SOSARs have an exercise price equal to the closing price on the grant date, vest in two equal installments on the 2nd and 3rd anniversaries of the grant date, subject to continued employment through the applicable vesting date, and have a 7-year term.

2023 RSUs

Messrs. Brandt and Boatwright received an annual grant of RSUs on February 9, 2023. These RSUs vest in two equal installments on the 2nd and 3rd anniversaries of the grant date, subject to continued employment through the applicable vesting date.

EARNOUT OF 2021-23 PSU Awards

In 2021, we granted PSUs to our public releaseexecutive officers that vested based on the company’s three-year CRS growth, measured from January 1, 2021 – December 31, 2023 and two-year average RCF margin, measured from January 1, 2022 – December 31, 2023. The number of financial resultsshares that could be earned under the award was determined by multiplying the target number of shares subject to the award by the payout percentage, as set forth in the table below:

| | 23.0% | | | 0% | | | 25% | | | 25% | | | 50% | | | 75% | | | 100% | | | 125% | | | 150% | |

| | 24.0% | | | 25% | | | 50% | | | 75% | | | 75% | | | 100% | | | 150% | | | 175% | | | 200% | |

| | 25.0% | | | 50% | | | 75% | | | 100% | | | 100% | | | 125% | | | 175% | | | 225% | | | 275% | |

| | 26.0% | | | 75% | | | 100% | | | 125% | | | 125% | | | 175% | | | 225% | | | 275% | | | 300% | |

| | 27.0% | | | 100% | | | 125% | | | 150% | | | 175% | | | 200% | | | 250% | | | 300% | | | 300% | |

In February 2024, the Committee evaluated the Company’s RCF and CRS performance against the goals for the

previous year. Equity awards are granted to officers outsidetwo performance metrics and certified payout for the 2021-2023 PSUs at 278% of

this annual award cycle only in exceptional circumstances, such as intarget based on 11.6% three-year CRS growth and 25.1% two-year average RCF margin for the

case of key hires or promotions.The committee may make additional long-term incentive awards, including equity awards, or delegate to one or more officers the authority to make such awards, to non-officer employees at any time throughout the year within the terms allowed in the Amended and Restated 2011 Stock Incentive Plan.

performance period.

Benefits and Perquisites

We

In addition to the principal compensation elements described above, we provide our executive officers with access to the same benefits we provide all of our full-time

employees. We also provide our officers withemployees as well as limited perquisites and other personal benefits that we believe are reasonable and

consistent with our compensation objectives,supported by market practice, personal safety and

with additional benefit programsconvenience that

are not available to all employees throughout our company.Perquisites are generally provided to help us attract and retain top performing employees for key positions, and in some cases perquisites are designed to facilitate our executive officers bringing maximum focus to what we believe to be demanding job duties. In addition to the perquisites identified in notes to the Summary Compensation Table below, we have occasionally allowed executive officers to be accompanied by a guest when traveling for business on an airplane owned or chartered by us. enhances productivity.

Executive officers on occasion have also used company-owned or chartered airplanes for personal trips; in those casestrips. We generally require the executive officer to fully reimbursesreimburse us for the incremental cost of personal use of the airplane,trips, except where prohibited by applicable regulations. Our executive officers are also provided with personal administrative and other services by company employees from time to time, including scheduling of personal appointments, performing personal errands, andregulations; however, the Board has preapproved Mr. Niccol’s limited use of company-provided drivers.the company-owned airplanes for personal trips. The Lead Independent Director reviews Mr. Niccol’s personal use of the company-owned aircraft each quarter to assess whether it is consistent with the Board’s approval. Other NEOs also may use the company-owned aircraft for personal travel on occasion and with prior approval of our CEO. We believe

that the perquisites we provide our executive officers are consistent with market practices and are reasonable and consistent with our compensation objectives.

We also administer a non-qualified deferred compensation plan

for our seniorthat permits eligible management employees, including our executive

officers.officers, who earn compensation greater than the maximum compensation that can be considered with respect to the 401(k) Plan, as set by the Internal Revenue Code. The plan allows participants to defer the obligation to pay taxes on certain elements of their compensation while also potentially receiving earnings on deferred amounts. We offer an employer match on a portion of the contributions made by the employees. We believe this plan is an important retention and recruitment tool because it helps facilitate retirement savings and financial flexibility for our key employees, and because many of the companies with which we compete for executive talent provide a similar plan to their key employees.

Discussion of 2015 Executive Officer Compensation Decisions

Assessment of Company Performance

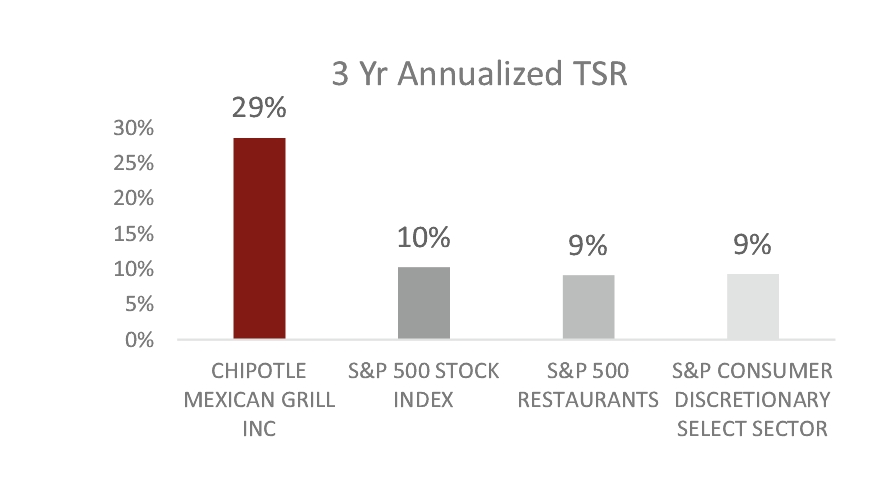

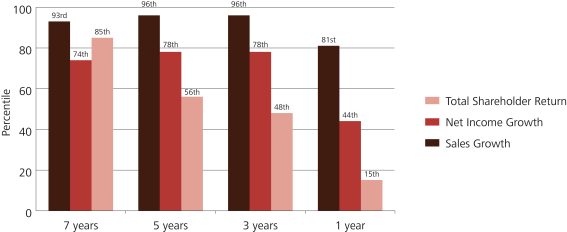

The committee sets the base salaries of, determines annual incentive award opportunities for, and makes long-term incentive awards to the executive officers during the first quarter of each year, generally in February. In making these decisions, the committee references our company performance over the short and long term, both in relative terms versus our restaurant industry peer group, and versus internal goals and expectations.

This assessment of company performance is only one factor used by the committee in making compensation decisions, as described in more detail below, but does play a significant role in the committee’s decision-making, consistent with our pay-for-performance philosophy. Because of our strong performance in 2014 and prior years relative to market-wide performance in our industry, the committee generally set compensation levels for our executive officers for 2015 at the upper end of the ranges that the committee believed to be appropriate for each executive officer.

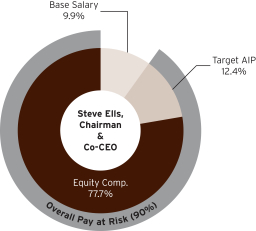

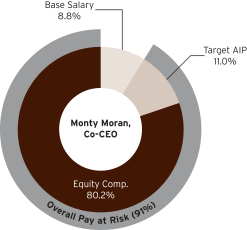

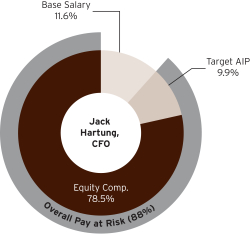

Base Salaries

To set base salary levels for 2015 for our executive officers, the committee considered the existing base salary of each officer, as well as each officer’s contribution level and effectiveness in his role, and the range of base salaries at our peer companies. In light of the strong performance of our company through the end of 2014 and based on the committee’s subjective determinations as to each officer’s individual performance and contribution to our significant growth, and also in light of the Co-CEO’s base salaries not increasing since 2012, each executive officer’s salary was increased for 2015. Base salaries for 2015 were increased to $1,540,000 for Mr. Ells and $1,320,000 for Mr. Moran, and

| | | | |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND2016 PROXY STATEMENT | | | 47 | |

| | |

Executive Officers and Compensation

(continued)

| |

|

were increased to $750,000, for Mr. Hartung and $535,000 for Mr. Crumpacker. The difference in the base salaries of Mr. Moran and Mr. Ells is attributable to Mr. Moran serving in the office of Co-Chief Executive Officer only since the beginning of 2009, whereas Mr. Ells is our founder and Chairman of the Board, and has served as Chief Executive Officer since our inception. The differences in salary between the Co-Chief Executive Officers and the other executive officers are attributable to the committee’s belief in the tremendous importance of strong leadership at the chief executive officer level as well as to the level of impact of the contributions made by the Co-Chief Executive Officers to our success.

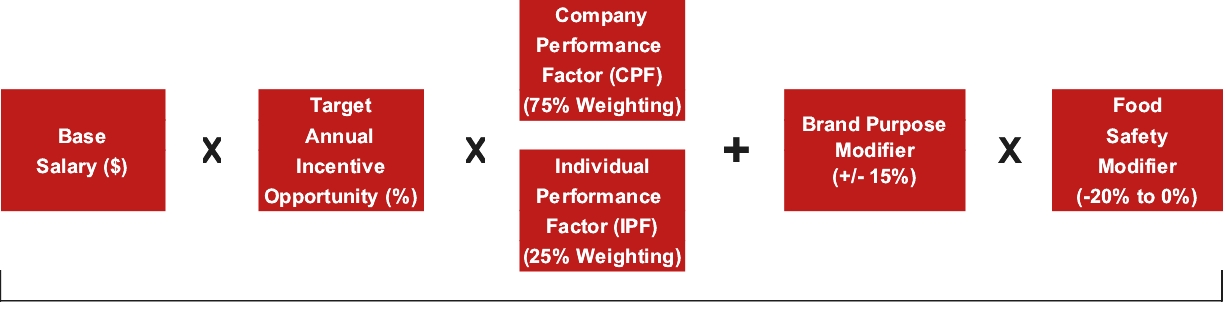

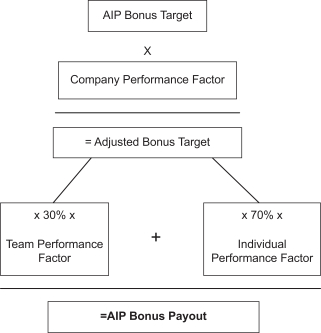

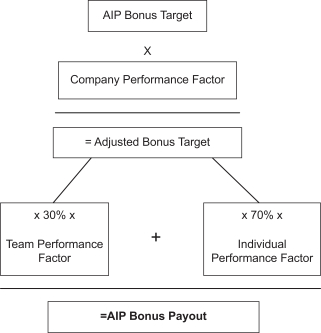

Annual Incentives—AIP Structure

The formula to determine payouts under the AIP consists of a company performance factor, a team performance factor, and an individual performance factor, each stated as a percentage by which an executive officer’s target payout amount will be adjusted to determine actual cash bonuses. The payout formula is as follows:

In most years, each of the company, team and individual performance factors could be adjusted downward to zero based on company, team or individual performance, which could result in no AIP bonuses being paid or an individual’s AIP bonus being significantly reduced. While adjustments downward have generally been much less significant, the potential for one or more factors to be significantly reduced ensures that AIP bonuses will be significantly reduced or not paid at all if our performance falls far short of our expectations, and enables us to avoid unduly rewarding employees not contributing to our success.

We include the company performance factor in the calculation to reward participating employees when our company performs well, which we believe focuses employees on improving corporate performance and aligns the interests of our employees with those of our shareholders. We include the team performance factor to promote teamwork and to provide rewards based on the areas of the company in which a participant can make the most impact. We include the individual performance factor to incentivize individual performance and to ensure individual accountability. Each of these components can reduce award levels when we, one of our “team” units, or an employee participating in the AIP don’t perform well, which further promotes accountability. We believe that as a whole, this structure results in the AIP rewarding our top performers, consistent with our goal of building shareholder value.

To determine the company and team performance factors for each year, during the first quarter of the year the committee approves targeted performance levels for a number of financial or operating measures (on a company-wide basis for the company performance factor and for each of our operating regions for the team performance factor), and key initiatives for improving our company during the year. The AIP formulas are structured so that achievement at the targeted level of each financial and operating measure and achievement (as determined subjectively by the committee) of the key initiatives would result in company and team performance factors that would result in payout at 100 percent—in other words, at target. Achievement above or below the targeted financial and operating measures, and over- or under-achievement of the key initiatives, results in adjustments upward or downward to the company and team performance factors, on a scale for each measure approved by the committee at the beginning of the year. The company and team performance factors to determine payouts are calculated after the conclusion of the year by referencing actual company and regional performance on each of the relevant financial and operating measures, and on the key initiatives, to the scales approved by the committee, and in unusual circumstances, following additional adjustments that the committee deems to be appropriate to account for unforeseen factors during the year. The company performance factor and the team performance factor for most corporate-level employees, including each of the executive officers, are capped at 150 percent. The team performance factor for most corporate-level employees, including each officer, is the average of the regional team performance factors, subject to adjustment based on other variables considered by the committee relating to our corporate employees.

| | |

48 | | NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND2016 PROXY STATEMENT |

| | |

Executive Officers and Compensation

(continued)

| |

|

The individual performance factor is a function of the individual employee’s performance rating for the year. The precise individual performance factor is set from zero to 130 percent following completion of the employee’s performance review, within a range of percentages associated with the employee’s performance rating. The committee evaluates the performance of the Co-Chief Executive Officers to determine each of their individual performance factors, and approves individual performance factors for each other executive officer after considering recommendations from the Co-Chief Executive Officers, in each case based on a subjective review of each officer’s performance for the year.

The committee also sets maximums each year for the company, team and individual performance factors. The committee may, in its discretion, authorize a deviation from the parameters set for any particular performance factor in order to account for exceptional circumstances and ensure that AIP bonuses further the objectives of our compensation programs.

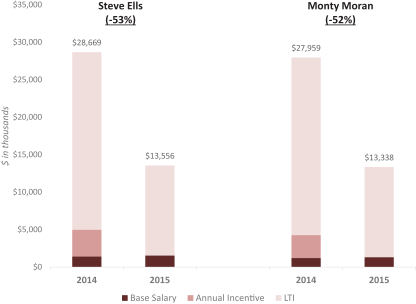

Annual Incentives – 2015 AIP Payouts

For 2015, as a result of the food-borne illness incidents that negatively impacted our results beginning in the fourth quarter of 2015, our results fell significantly short of our performance targets, resulting in no bonuses being paid to the executive officers under the AIP.

The committee set the target annual AIP payouts for each executive officer during the first quarter of 2015, based in part by reference to the historical compensation of each officer, each officer’s performance during the year, and median target bonuses for comparable positions within the restaurant industry peer group. The AIP parameters allow for maximum payouts equal to 204 percent of the target award, which the committee believes is adequate to reward achievement of outstanding results and motivate our employees to drive superior performance.

For 2015, as with past years, the four measures the committee selected to be used in determining the company and team performance factors were income from operations (prior to accrual for AIP payouts and stock compensation expense), new restaurant average daily sales, comparable restaurant sales increases, and new restaurant weeks of operation. Targeted performance for each measure was set as follows:

| | | | 2024 Proxy Statement 67 | |

Performance Measure | | Target | |

Operating Income (before AIP and stock compensation expense)

| | $ | 1,067.9 million | |

New Rest. Avg. Daily Sales

| | | $5,278 | |

Comparable Rest. Sales Increase

| | | 7.0 | % |

New Weeks of Operations

| | | 5,188 | |

Consistent with our pay-for-performance philosophy these targets represented stretch goals, the achievement of which would have generally resulted in our financial results exceeding the base-level forecast results in our 2015 operating plan and equaling or exceeding the full-year 2015 guidance we publicly issued to investors. Performance on operating income, as adjusted, was weighted most heavily in the computation of the company performance factor, because we believe profitability is the most important measure of our financial success and driver of shareholder value.

In order to provide a strong incentive towards superior performance, the adjustment scales for the company performance factor were set such that overachievement against each goal would have resulted in upward adjustments at a higher rate than the rate at which equivalent levels of underachievement would have resulted in downward adjustments.

The targeted performance and adjustments for each of these measures on a regional level, other than new restaurant weeks of operation, were used to calculate the team performance factor for corporate-level employees as well. The regional performance targets and variance adjustments were set at the regional level consistent with the scales described above for the company performance factor.

The key initiatives targeted for 2015 were building Restaurateur cultures, setting salaried managers up for success, developing outstanding crew members, extraordinary customer service and throughput, and focusing on the fundamentals of our business. The committee’s subjective determination of our level of achievement against these initiatives results in a specified adjustment to the company performance factor, though the adjustment attributable to the key initiatives is set at a maximum of five percent in either direction, considerably less than most other metrics impacting the company performance factor.

Due to the food-borne illness incidents that negatively impacted our results in 2015, our company performance factor was 0 percent, resulting in no AIP payouts to the executive officers.

| | | | |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND2016 PROXY STATEMENT | | | 49 | |

| | |

Executive Officers and Compensation

(continued)

| |

|

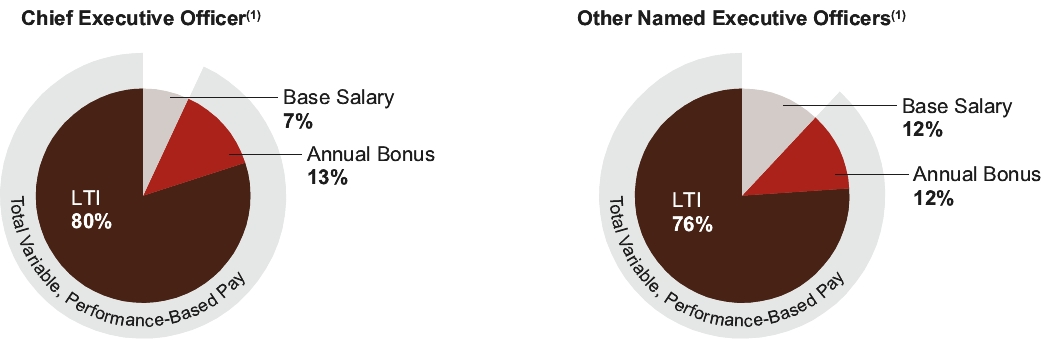

Long-Term Incentives – Performance Share Awards

2015 Performance Share Awards

In February 2015, in response to the say-on-pay vote at our 2014 annual meeting of shareholders and following extensive engagement with shareholders representing more than one-half of our shares outstanding, the committee made long-term incentive awards to each executive officer in the form of new performance share awards, in lieu of SOSARs. The performance share awards incorporate a three-year performance-contingent vesting period based on Chipotle’s relative performance return versus a restaurant industry peer group in three equally-weighted measures:

TABLE OF CONTENTS

average revenue growth,

OTHER COMPENSATION-RELATED POLICIES total shareholder return.

The awards will pay out at the target number of shares set forth below if our relative achievement versus the peer group, averaged across the three performance measures, is at the 65th percentile; will pay out at two times the target number of shares set forth below if our averaged relative percentile achievement versus the peer group is at or above the 90th percentile; and will pay out at one-half the target number of shares set forth below if our averaged relative percentile achievement versus the peer group is at the 35th percentile. Payout for achievement in between the 35th and 65th, and between the 65th and 90th, percentiles will be interpolated linearly between the threshold and target payout levels or target and maximum payout levels, as applicable. Averaged relative achievement versus the peer group below the 35th percentile will result in expiration of the awards with no payout. The shares issuable at the threshold, target and maximum performance levels, and the reduction in grant date value of the awards versus total officer equity awards in 2014, are set forth below.

| | | | | | | | | | | | | | | | | | | | |

| OFFICER NAME | | SHARES

EARNED FOR

PERFORMANCE

BELOW

THRESHOLD | | | THRESHOLD:

SHARES

EARNED AT

35TH

PERCENTILE | | | TARGET:

SHARES

EARNED AT

65TH

PERCENTILE | | | MAXIMUM:

SHARES

EARNED AT

90TH

PERCENTILE | | | % REDUCTION

FROM 2014

LTI

VALUE | |

Steve Ells | | | 0 | | | | 7,444 | | | | 14,887 | | | | 29,774 | | | | 49.2 | % |

Monty Moran | | | 0 | | | | 7,444 | | | | 14,887 | | | | 29,774 | | | | 49.2 | % |

Jack Hartung | | | 0 | | | | 3,126 | | | | 6,252 | | | | 12,504 | | | | 37.8 | % |

Mark Crumpacker | | | 0 | | | | 2,233 | | | | 4,466 | | | | 8,932 | | | | 11.2 | % |

Performance will be calculated over the three year period beginning January 1, 2015 and ending December 31, 2017. The peer group used to measure relative performance under these awards is the same peer group disclosed on page 45. Vesting and payout of each award is subject to the recipient’s continued employment through the vesting date, subject to the potential pro-rata payout to the recipient or his estate in the event of termination due to death, disability or retirement, and to potential accelerated vesting in the event of certain terminations within two years of certain change in control transactions.

The committee believes that this departure from prior equity compensation award practices for the executive officers effectively continued our performance-based compensation programs and encouraged our officers to continue to drive the creation of shareholder value, while addressing the principal points of concern raised by shareholders with our past compensation practices.

2016 Performance Share Awards

In late 2015, the committee evaluated how to approach executive officer equity compensation following the business challenges we faced during the second half of the year. After significant analysis and input from Pay Governance, the committee concluded that using operating or relative performance metrics for the 2016 equity awards would not be optimal. The committee had concerns that using 2015 year-end financials or stock price at the beginning of 2016 as the basis for performance evaluation could create a misalignment of shareholder returns and executive officer compensation. More specifically, the committee recognized that performance against the measures incorporated into the 2015 performance share awards may not translate into rebuilding lost shareholder value.

| | |

50 | | NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND2016 PROXY STATEMENT |

| | |

Executive Officers and Compensation

(continued)

| |

|

In early 2016, we discussed some of these issues and potential equity program changes with a number of our largest shareholders. Following those discussions and after further review and analysis, for 2016, the Compensation Committee decided to continue using performance shares for the executive officer equity compensation program. However, the 2016 performance shares will be tied solely to highly-challenging absolute stock price performance goals over a three-year performance period beginning February 3, 2016. The committee considered alternative performance metrics to be used for the 2016 performance shares, but ultimately concluded that restoring lost shareholder value was paramount. Further, the committee also concluded that granting SOSARs or other option-like awards would not be appropriate given the low strike price that would be associated with this type of grant.

Chipotle has undertaken a broad array of initiatives to address the issues that led to the stock price decline in 2015. The committee concluded that the 2016 performance share awards will continue to motivate our executive officers to ensure the successful implementation of these initiatives, thereby rebuilding customer confidence in the Chipotle brand. If that happens, we believe improved business results and stock price performance will follow.

Vesting of the awards will be based on Chipotle’s stock price performance over the performance period.The awards will pay out only if the average closing price of Chipotle’s common stock for any period of 30 consecutive trading days during the performance term is at least $700, which is approximately 52% higher than the closing price of Chipotle’s common stock on the grant date. The number of shares issuable at the end of the performance term will be determined based on the highest average closing stock price achieved for any period of 30 consecutive trading days during the performance term. The number of shares to be issuable to each executive officer at assumed levels of performance are set forth below.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Number of Shares Issued at Assumed 30-Day Average Stock

Price Achievement During Performance Term | |

| Officer Name | | Below $700 | | | $700

(Threshold) | | | $800

(Target) | | | $900 | | | $1,000 | | | $1,200

(Maximum) | |

Steve Ells | | | 0 | | | | 13,500 | | | | 27,000 | | | | 54,000 | | | | 81,000 | | | | 108,000 | |

Monty Moran | | | 0 | | | | 13,500 | | | | 27,000 | | | | 54,000 | | | | 81,000 | | | | 108,000 | |

Jack Hartung | | | 0 | | | | 5,675 | | | | 11,350 | | | | 22,700 | | | | 34,050 | | | | 45,400 | |

Mark Crumpacker | | | 0 | | | | 4,050 | | | | 8,100 | | | | 16,200 | | | | 24,300 | | | | 32,400 | |

Illustrative Market Capitalization(1) (was $13.8 billion at grant date) | | | | | | $

| 21.1

billion |

| | $

| 24.1

billion |

| | $

| 27.2

billion |

| | $

| 30.3

billion |

| | $

| 36.4

billion |

|

(1) | Illustrative market capitalization is based on shares outstanding as of the grant date, plus shares issuable at each stock price performance hurdle. |

The number of shares to be issuable between the various performance levels depicted above will be determined by linear interpolation between the next highest and lowest of the depicted performance levels. If the closing price of Chipotle common stock does not average at least $700 for any period of 30 consecutive trading days during the performance term, the awards will expire with no payout. The vesting and payout of the awards will be subject to the recipient’s continued employment through the end of the performance term, subject to the potential pro-rata payout, based on actual stock price performance, to the recipient or his estate in the event of termination due to death, disability or retirement, and to potential accelerated vesting in the event of certain terminations within two years of certain change in control transactions.

The awards described above are intended to be the only equity incentive awards made to Chipotle’s executive officers during 2016, and are in lieu of all other performance share, restricted stock, stock appreciation rights, option or other equity awards that otherwise could be made to the executive officers during 2016 under the Amended and Restated Chipotle Mexican Grill, Inc. 2011 Stock Incentive Plan.

Vesting of Previously-Granted Performance SOSARs

As of December 31, 2014, the performance criteria on the second tranche of Performance SOSARs granted in 2012, and on the first tranche of Performance SOSARs granted in 2013, were satisfied. Accordingly in February 2015 the awards became vested and exercisable. The performance criteria on these awards was the achievement of cumulative adjusted cash flow from operations as follows:

| | | | | | | | |

AWARD | | PERFORMANCE PERIOD | | | CUM. ADJ. CASH FLOW FROM OPS | |

2012 Performance SOSARs

| | | 1/1/2012 to 12/31/2014 | | | $ | 1.472 billion | |

2013 Performance SOSARs

| | | 1/1/2013 to 12/31/2014 | | | $ | 1.158 billion | |

| | | | |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND2016 PROXY STATEMENT | | | 51 | |

| | |

Executive Officers and Compensation

(continued)

| |

|

As of December 31, 2015, the performance criteria on the second tranche of Performance SOSARs granted in 2013, and on the first tranche of Performance SOSARs granted in 2014, were satisfied. Accordingly, following certification of the achievement of the performance criteria on these awards, the second tranche of the 2013 Performance SOSAR awards and the first tranche of the 2014 Performance SOSAR awards will vest and become exercisable. The performance criteria on these awards was the achievement of cumulative adjusted cash flow from operations as follows:

| | | | | | | | |

AWARD | | PERFORMANCE PERIOD | | | CUM. ADJ. CASH FLOW FROM OPS | |

2013 Performance SOSARs

| | | 1/1/2013 to 12/31/2015 | | | $ | 1.761 billion | |

2014 Performance SOSARs

| | | 1/1/2014 to 12/31/2015 | | | $ | 1.729 billion | |

2013 Performance Share Awards

The end of the third quarter of 2014 represented conclusion of the second year of the three-year performance period for performance shares awarded in December of 2013. These performance share awards consist of a right to receive a pre-determined number of shares of our common stock based on our achievement of cumulative adjusted cash flow from operations over the performance period at a threshold, target or maximum level. These awards are reflected below in the Outstanding Equity Awards at December 31, 2015 table below.

Executive Stock Ownership Guidelines

Our Board of Directors has adopted stock

Stock ownership

guidelines for our executive officers. These guidelines are intended to ensure that our executive officers retain ownership of a sufficient amount of Chipotle stock to align their interests in a meaningful way with

thosethe interests of our

long-term shareholders. Alignment of our employees’ interests with those of our shareholders is a principal purpose of the equity component of our compensation program.

The Committee believes that the stock ownership guidelines reflectedfor our NEOs are robust and in the case of the CEO and CFAO, the requirements are among the highest in our compensation peer group. The table below reflects our guidelines and compliance by our NEOs with the guidelines as of December 31, 2023.

| | Brian Niccol | | | 7 times | | | ✓ | |

| | Jack Hartung | | | 4 times | | | ✓ | |

| | Curt Garner | | | 3 times | | | ✓ | |

| | Chris Brandt | | | 3 times | | | ✓ | |

| | Scott Boatwright | | | 3 times | | | ✓ | |

Compliance with the stock ownership requirements is evaluated each year on the last trading day of the calendar year using the average closing price of Chipotle’s common stock over the 30 trading days ending on and including the last trading day of the calendar year. Executive officers have five years to achieve the requisite ownership; however, if an executive officer is not on track to meet the applicable ownership requirement by the end of the third year, he or she (i) cannot sell shares of common stock owned outright, if any, and (ii) must retain at least 50% of the shares received upon the vesting of a

targeted numberRSU, PSU or other full-value equity award, and/or the exercise of an option or SOSAR, measured after withholding of shares

to be owned, are presented below.by the company for the exercise price. The guidelines are reviewed

for possible adjustment each yearannually and may be adjusted by the

committeeCommittee at any time.

| | | | | | | | |

| OFFICER | | # OF

SHARES | | | ACTUAL

OWNERSHIP | |

Steve Ells | | | 31,000 | | | | 196,802 | |

Monty Moran | | | 31,000 | | | | 154,755 | |

Jack Hartung | | | 7,000 | | | | 30,464 | |

Mark Crumpacker | | | 3,000 | | | | 3,000 | |

Shares underlying unvested restricted stock or restricted stock unitsRSUs count towards satisfaction of the guidelines, while shares underlying stock options and SOSARs (whether vested or unvested) and unearned performance shares and PSUs do not count. Executive officers who do notAs of December 31, 2023, all of our NEOs satisfied, exceeded or were on track to meet the guidelines are allowed five years to acquirethese requirements within the requisite numbertime period.

Stock ownership guidelines applicable to non-employee members of

sharesour Board are described on page 22. Executive Compensation Recovery Policy Chipotle’s Executive Compensation Recovery Policy requires the Board to comply. Allpursue reimbursement of incentive-based compensation paid or awarded to an executive officer if the payment or award was predicated upon the achievement of certain financial results that subsequently were the subject of a restatement, and a lower payment or award would have been made to the executive officer based upon the restated financial results. The clawback covers incentive-based compensation paid or awarded on or after October 2, 2023 and during the three fiscal years prior to the restatement. In addition, the Board may require forfeiture of an executive officer’s compensation, both cash and equity, if the executive officer engaged in egregious conduct substantially detrimental to the company. Our policy complies with and exceeds the New York Stock Exchange listing standards that became effective in 2023.

Prohibition on Hedging and Pledging To further align the interests of our executive officers meetwith the stock ownership guidelines. We also have adopted a policy prohibitinginterests of our shareholders, we prohibit our directors, executive officers and certain employees including all of the executive officers,who have access to material, nonpublic information, from hedging their Chipotle

stock ownership or pledging theirany shares of Chipotle common stock, holding shares of Chipotle common stock in a margin account or otherwise pledging shares of Chipotle common stock as collateral for loans.

Tax And Other Regulatory Considerations

Code Section 162(m)

Section 162(m)loans, and engaging in put options, call options, covered call options or other derivative securities in Chipotle common stock on an exchange or in any other organized market.

Our current and historical practice is to grant LTI awards to senior management during periods when our trading window for insiders is open. Our annual grant date, which generally includes the annual grant of the Internal Revenue Code provides that compensation of more than $1,000,000 paidLTI awards to the chief executive officer or to certainNEOs and other executive officers, usually occurs within one week after we publicly announce our financial results for the fourth quarter and full fiscal year. The Compensation, People and Culture Committee approves all LTI awards to executive officers and has delegated authority to our CEO, Chief Human Resources Officer and General Counsel to make grants of a public company will not be deductible for federal income tax purposes unless amounts above $1,000,000 qualify for one of several exceptions. The committee’s primary objective in designing executive compensation programs isLTI awards, within specified parameters, to support and encourage the achievement of our company’s strategic goalsnon-executive officer employees and to enhance long-term shareholder value. For thesenewly hired or newly promoted employees below the executive officer level, which also generally occur only during periods when our trading window for insiders is open.

| | | | 2024 Proxy Statement 68 | | |

TABLE OF CONTENTS

In February 2024, the Compensation, People and other reasons,Culture Committee approved the committee has determined that it will not necessarily seekChipotle Mexican Grill, Inc. Executive Officer Severance Plan (the “Severance Plan”). The Severance Plan provides severance benefits to limitour executive compensationofficers, including the NEOs, if their employment is terminated either by us without “cause” (excluding termination due to death or disability) or due to their resignation for “good reason” (each as defined in the Severance Plan) (a “Qualifying Termination”).

An executive officer who experiences a Qualifying Termination would be eligible to receive (i) cash severance equal to the

amount that will be fully deductible under Section 162(m).We have implemented the 2014 Cash Incentive Plan as an umbrella plan under which AIP bonuses are paid in order to meet requirements to deduct the amountsum of the payouts from our reported income under Section 162(m). Under the 2014 plan, the committee sets maximum bonuses for each executive officer and other key employees. If thetheir base salary plus target cash bonus amount determined under the AIP for participantsthe year in which the Qualifying Termination occurs multiplied by two, in the 2014 plan is lower thancase of the maximumCEO, or one and one-half, in the case of other executive officers, paid in equal installments over 24 months, for the CEO, and 18 months for other executive officers, plus (ii) a pro-rated portion of their annual bonus set under the 2014 plan, the committee has historically exercised discretion to pay the lower AIP bonus rather than the maximum bonus payable under the 2014 plan. In instances where the committee has determined to pay bonuses in excess of those determined under the AIP such additional

for the year in which the Qualifying Termination occurs, based on the Company’s actual performance, plus (iii) the cash equivalent of the employer portion of the cost of the Company group health plans in which the executive officer was participating immediately prior to the Qualifying Termination for 24 months, with respect to the CEO, or for 18 months, with respect to other executive officers. In addition, each executive officer would vest in a pro-rata portion of their unvested equity awards, with the performance-based equity awards vesting based on the Company’s actual performance. Any SOSARs held by the executive officer would be exercisable for 12 months after the Qualifying Termination or if earlier, until the expiration date. | | |

52 | | NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND2016 PROXY STATEMENT |

| | |

Executive Officers and Compensation

(continued)

| |

|

bonuses were paidTo be eligible for benefits under the predecessor toSeverance Plan, the 2014 planexecutive officer must timely execute and not revoke a separation and general release agreement, in combination with AIP bonuses, were less than the maximum bonuses fixedform provided by the Company, which contains customary confidentiality, non-solicitation and non-disparagement restrictions.

An executive officer cannot receive benefits under the

plan.Accounting Rules

Various rulesSeverance Plan if they become eligible to receive benefits under generally accepted accounting principles determine the mannerChipotle Mexican Grill, Inc. Change in Control Severance Plan.

In February 2024 the Compensation, People and Culture Committee also approved a letter agreement with Brian Niccol providing that, if he is subject to a Qualifying Termination under the Severance Plan, he would receive an additional 12 months of pro-rated vesting credit for any equity awards held by him on the Qualifying Termination Date. See “Potential Payments Upon Termination or Change-In-Control – Severance Arrangements” for more details.

Change in Control Severance Plan We have a Change in Control Severance Plan (“CIC Plan”) to encourage retention of key management employees in the event of a change in control, which we accountis designed to help incent key executives to remain with the company during the pendency of any planned or unexpected change in control of the company. Severance benefits are only payable in the event a change in control of the company occurs and an executive officer’s employment is terminated without cause or by him or her for equity-basedgood reason (each as defined in the plan). See “Potential Payments Upon Termination or Change-In-Control – Change in Control Severance Plan” for more details.

Compensation Program Risk Assessment F.W. Cook, an independent executive compensation consulting firm retained by the Compensation, People and Culture Committee, conducted a risk assessment of our compensation programs in March 2024 and concluded that our financial statements. compensation policies, practices and programs do not create risks that are reasonably likely to have a material adverse effect on Chipotle. F.W. Cook’s assessment included a review of our pay and incentive plan structures, pay practices and policies and governance processes, the Compensation, People and Culture Committee’s oversight of such programs and available recoupment policies in place to help mitigate risk.

The committee may considerrisk assessment considered the accounting treatment underfollowing factors:

Financial Accounting Standards Board Accounting Standards Codification Topic 718 (FASB Topic 718)Our executive compensation program is designed to encourage behaviors aligned with the long-term interests of alternative grant proposals when determiningshareholders, with a significant portion of executive compensation awarded in the form of long-term equity incentives.

There is appropriate balance in the executive compensation program structure to mitigate compensation-related risk with fixed and timing of equityvariable pay; cash and equity; corporate and individual goals; formulas and discretion; and short-term and long-term measurement periods.

We have policies to mitigate compensation grantsrisk including stock ownership guidelines, insider trading prohibitions, discretion to reduce payments, forfeiture provisions, independent Compensation, People and Culture Committee oversight, and a compensation recovery and clawback policy.

Compensation, People and Culture Committee oversight extends to incentive plans below the executive officer level, where no potential material compensation-related risk was identified.

In structuring and approving our executive officers.compensation programs, as well as policies and procedures relating to compensation throughout our company, the Compensation, People and Culture Committee also considers risks that may be inherent in such programs, policies and procedures. The accounting treatment of such grants, however, is not generally determinativeCommittee reviewed the assessment of the type, timing, or amount ofcompany’s 2023 compensation program and discussed the report with management and, based on its review, determined that any particular grant of equity-basedrisks arising from the company’s compensation policies and practices for our employees are not reasonably likely to have a material adverse effect on the committee determines to make.company.

| | | | 2024 Proxy Statement 69 | | |

COMPENSATION COMMITTEE REPORTTABLE OF CONTENTS

Compensation, People and Culture Committee Report

The Compensation,

People and Culture Committee reviewed and discussed the Compensation Discussion and Analysis included in this

Proxy Statementproxy statement with management. Based on such review and discussion, the

Compensation Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this

Proxy Statementproxy statement and Chipotle’s Annual Report on Form 10-K for filing with the SEC.

The

Compensation,

People and Culture Committee.

Neil W. Flanzraich,

Patricia Fili-Krushel, Chairperson

Patrick J. Flynn

Darlene J. Friedman

Gregg Engles

Laura Fuentes

| | | | 2024 Proxy Statement 70 | |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND2016 PROXY STATEMENT | | | 53 | |

| | |

Executive Officers and Compensation

(continued)

| |

|

TABLE OF CONTENTS

20152023 COMPENSATION TABLES

In reviewing the compensation information included below, it is important to bear in mind that consistent with past practice, compensation decisions for 2015 were made early in the year. Consequently, the amounts and awards reflected in the compensation tables below primarily reflect decisions made well before the fourth quarter of 2015 and the difficulties we experienced in our business during that time.

2023 SUMMARY COMPENSATION TABLE

| | | | | | | | | | | | | | | | | | | | | | | | | | |

NAME AND PRINCIPAL POSITION | | YEAR | | SALARY | | | STOCK

AWARDS(1) | | | OPTION

AWARDS(2) | | | NON-EQUITY

INCENTIVE PLAN

COMPENSATION(3) | | | ALL OTHER

COMPENSATION(4) | | | TOTAL | |

STEVE ELLS | | 2015 | | $ | 1,526,000 | | | $ | 12,030,036 | | | | — | | | | — | | | $ | 281,858 | | | $ | 13,837,894 | |

| Chairman and Co-Chief Executive Officer | | 2014 | | $ | 1,400,000 | | | | — | | | $ | 23,698,500 | | | $ | 3,570,000 | | | $ | 255,770 | | | $ | 28,924,270 | |

| | 2013 | | $ | 1,400,000 | | | $ | 7,961,250 | | | $ | 12,304,500 | | | $ | 3,196,816 | | | $ | 254,305 | | | $ | 25,116,871 | |

MONTY MORAN | | 2015 | | $ | 1,308,000 | | | $ | 12,030,036 | | | | — | | | | — | | | $ | 223,041 | | | $ | 13,561,077 | |

| Co-Chief Executive Officer | | 2014 | | $ | 1,200,000 | | | | — | | | $ | 23,698,500 | | | $ | 3,060,000 | | | $ | 194,702 | | | $ | 28,153,203 | |

| | 2013 | | $ | 1,200,000 | | | $ | 7,961,250 | | | $ | 12,304,500 | | | $ | 2,740,128 | | | $ | 191,176 | | | $ | 24,397,054 | |

JACK HARTUNG | | 2015 | | $ | 745,769 | | | $ | 5,052,179 | | | | — | | | | — | | | $ | 235,361 | | | $ | 6,033,309 | |

| Chief Financial Officer | | 2014 | | $ | 700,000 | | | | — | | | $ | 8,125,200 | | | $ | 1,213,800 | | | $ | 206,842 | | | $ | 10,245,842 | |

| | 2013 | | $ | 645,719 | | | $ | 3,980,625 | | | $ | 4,101,500 | | | $ | 975,501 | | | $ | 179,004 | | | $ | 9,882,349 | |

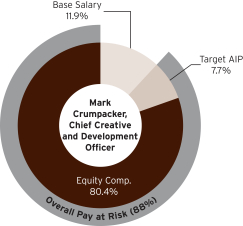

MARK CRUMPACKER | | 2015 | | $ | 532,077 | | | $ | 3,608,930 | | | | — | | | | — | | | $ | 141,581 | | | $ | 4,282,588 | |

| Chief Creative and Development Officer | | 2014 | | $ | 500,000 | | | | — | | | $ | 4,062,600 | | | $ | 663,000 | | | $ | 109,591 | | | $ | 5,335,191 | |

| | 2013 | | $ | 402,580 | | | $ | 3,184,500 | | | $ | 1,692,400 | | | $ | 506,328 | | | $ | 107,054 | | | $ | 5,892,862 | |

| | Brian Niccol

Chairman and Chief Executive Officer | | | 2023 | | | $ 1,292,308 | | | $ 9,300,795 | | | $6,200,364 | | | $5,200,000 | | | $ 479,961 | | | $22,473,427 | |

| | 2022 | | | $1,250,000 | | | $8,101,452 | | | $5,400,343 | | | $2,115,000 | | | $319,359 | | | $17,186,154 | |

| | 2021 | | | $1,250,000 | | | $7,200,970 | | | $4,800,102 | | | $4,342,500 | | | $287,008 | | | $17,880,580 | |

| | Jack Hartung

Chief Financial and Administrative Officer | | | 2023 | | | $865,000 | | | $ 3,300,593 | | | $2,200,112 | | | $1,903,000 | | | $114,577 | | | $8,383,282 | |

| | 2022 | | | $862,692 | | | $2,400,138 | | | $1,600,202 | | | $894,410 | | | $81,451 | | | $5,838,893 | |

| | 2021 | | | $844,615 | | | $2,100,961 | | | $1,400,358 | | | $1,598,000 | | | $224,740 | | | $6,168,673 | |

| | Curt Garner

Chief Customer and Technology Officer | | | 2023 | | | $775,385 | | | $3,000,101 | | | $2,000,384 | | | $1,560,000 | | | $90,644 | | | $7,426,514 | |

| | 2022 | | | $746,154 | | | $2,400,138 | | | $1,600,202 | | | $695,625 | | | $78,086 | | | $5,520,205 | |

| | 2021 | | | $717,308 | | | $2,100,961 | | | $1,400,358 | | | $1,329,288 | | | $156,797 | | | $5,704,712 | |

| | Chris Brandt

Chief Brand Officer | | | 2023 | | | $720,384 | | | $3,602,692 | | | $900,328 | | | $1,305,000 | | | $96,374 | | | $6,624,779 | |

| | 2022 | | | $691,923 | | | $2,220,246 | | | $1,480,345 | | | $572,333 | | | $78,055 | | | $5,042,902 | |

| | 2021 | | | $671,154 | | | $1,800,612 | | | $1,200,025 | | | $1,107,338 | | | $120,131 | | | $4,899,260 | |

| | Scott Boatwright

Chief Operating Officer | | | 2023 | | | $607,500 | | | $3,602,692 | | | $900,328 | | | $1,170,000 | | | $66,252 | | | $6,346,772 | |

| | 2022 | | | $562,692 | | | $2,220,246 | | | $1,480,345 | | | $465,278 | | | $52,515 | | | $4,781,076 | |

| | 2021 | | | $546,154 | | | $1,950,047 | | | $1,300,388 | | | $902,275 | | | $140,151 | | | $4,839,015 | |

(1)

| Amounts under “Stock Awards” represent the grant date fair value under FASB Topic 718 of the 2023 annual grant of (i) performance shares awarded in 2013 and 2015 and for which vesting was consideredshare units (PSUs), based on the probable achievement as of the date of grant, date.and (ii) restricted stock units (RSU). See Note 68 to our audited consolidated financial statements for the year ended December 31, 2015,2023, which are included in our Annual Report on Form 10-K filed with the SEC on February 5, 2016,8, 2024 for descriptions of the methodologies and assumptions we use to value stock awards and the manner in which we recognize the related expense pursuant to FASB ASC Topic 718. The 2023 annual PSU awards will only pay out to the extent the two performance metrics (three-year cumulative restaurant cash flow (RCF) dollars and total number of new restaurant openings (NROs)) equal or exceed the predetermined threshold performance levels over the 2023 through 2025 performance period. The PSU awards reflect an assumed target outcome of the performance conditions and do not reflect the value that ultimately may be realized by the executive officer. The aggregate grant date fair value of the 20152023 PSU awards, assuming the highest level ofmaximum performance, were achieved (which was determined not to be probable as of the grant date) would have been $17,399,032is $27.9 million for Mr. Ells and Mr. Moran; $7,306,962Niccol, $9.9 million for Mr. Hartung;Hartung, $9.0 million for Garner, and $5,219,593$8.1 million for Mr. Crumpacker.Messrs. Brandt and Boatwright. For further details, see “Compensation Discussion and Analysis – 2023 Compensation Program.” For 2023, the annual grant to executive officers was in the form of 60% PSUs, 20% stock-only stock appreciation rights (SOSARs), and 20% individual choice between RSUs or SOSARs with an equivalent grant value. Messrs. Brandt and Boatwright elected to receive 20% of their 2023 grant in the form of RSUs; the other NEOs elected to receive 40% of their 2023 grant in the form of SOSARs rather than receive RSUs. |

(2)

| Amounts under “Option Awards” represent the grant date fair value under FASB Topic 718 of SOSARs awarded in the relevant year.2023. See Note 68 to our audited consolidated financial statements for the year ended December 31, 2015,2023, as referenced in footnote 1,(1), for descriptions of the methodologies and assumptions we use to value SOSAR awards and the manner in which we recognize the related expense pursuant to FASB ASC Topic 718. |

(3)

| Amounts under “Non-Equity Incentive Plan Compensation” represent the amountscash payouts earned under the AIPannual incentive plan (AIP) for the relevant year,year. Under the 2023 AIP, payouts to our executive officers that exceed 200% of target are paid in the form of RSUs that vest in two equal installments on the second and third anniversaries of the grant date, subject to continued employment through the applicable vesting date. For 2023, AIP payouts exceeded 200% and, as described undera result, each of the NEOs was granted RSUs with the following grant values in lieu of cash on the same date as the 2024 annual LTI grant: Mr. Niccol ($585,000), Mr. Hartung ($178,406), Mr. Garner ($126,750), Mr. Brandt ($106,031) and Mr. Boatwright ($117,000). Only the cash portion of the 2023 AIP payouts is included in the table above. For further discussion, see “Compensation Discussion and Analysis – Discussion of Executive Officer Compensation Decisions – Annual Incentives – AIP Structure” and “– 2015 AIP Payouts.Incentive Plan (AIP).” |

(4)

| Amounts undershown in the “All Other Compensation” column for 2015 include2023 consist of the following: |

Matching contributions we made on the executive officers’ behalf to the Chipotle Mexican Grill, Inc. 401(K) plan as well as the Chipotle Mexican Grill, Inc. Supplemental Deferred Investment Plan, in the aggregate amounts of $205,692 for Mr. Ells, $176,308 for Mr. Moran, $80,398 for Mr. Hartung, and $48,474 for Mr. Crumpacker. See “Non-Qualified Deferred Compensation for 2015” below for a description of the Chipotle Mexican Grill, Inc. Supplemental Deferred Investment Plan.

Company car costs, which include the depreciation expense recognized on company-owned cars or lease payments on leased cars (in either case less employee payroll deductions), insurance premiums, and maintenance and fuel costs. Company car costs for Mr. Ells were $60,496, for Mr. Moran were $37,074, for Mr. Hartung were less than $25,000, and for Mr. Crumpacker were $32,028.

Housing costs, including monthly rent and utilities payments, of $35,392 for Mr. Hartung and $45,274 for Mr. Crumpacker.

$14,918 for Mr. Ells, $8,906 for Mr. Moran, $63,294 for Mr. Hartung, and $15,071 for Mr. Crumpacker for reimbursement of taxes payable in connection with taxable perquisites under rules of the Internal Revenue Service.

Commuting expenses, which include air fare, airport parking and ground transportation relating to travel between home and our company headquarters, for Mr. Hartung totaling $38,604.

| | Brian Niccol | | | $231,000 | | | $200,000 | | | $763 | | | $48,197 | | | $479,961 | |

| | Jack Hartung | | | $107,712 | | | $0 | | | $918 | | | $5,947 | | | $114,577 | |

| | Curt Garner | | | $84,017 | | | $0 | | | $680 | | | $5,947 | | | $90,644 | |

| | Chris Brandt | | | $82,151 | | | $0 | | | $759 | | | $13,464 | | | $96,374 | |

| | Scott Boatwright | | | $59,598 | | | $0 | | | $698 | | | $5,956 | | | $66,252 | |

(a)

| | |

54 | | NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND2016 PROXY STATEMENTConsists of matching contributions made by the company to Chipotle’s 401(k) Plan and the Supplemental Deferred Investment Plan for the benefit of the executive. The Supplemental Deferred Investment Plan is a nonqualified deferred compensation arrangement for employees who earn compensation greater than the maximum compensation that can be considered with respect to the 401(k) Plan, as set by the Internal Revenue Code. See “Nonqualified Deferred Compensation for 2023” for more details on this plan. |

| | | |

Executive Officers and Compensation

(continued)

| 2024 Proxy Statement 71 |

| |

TABLE OF CONTENTS

(b)

| Consists of the aggregate incremental costs of personal use by Mr. Niccol of company-owned aircraft, which use was approved by our Board. The aggregate incremental costs include costs billed by the applicable third-party or, for company-owned aircraft, the hourly operating cost of the aircraft, consisting of fuel costs, and other operating costs such as crew expenses, catering and landing fees. |

(c)

| Consists of the company’s reimbursement of taxes payable by the executive in connection with use of a meal card to receive a set amount of free Chipotle meals each month, which meal card is provided broadly to all the company’s corporate and field management employees. The meal card perquisite is not required to be included in the table above since it is available to a broad base of company employees, but the perquisite is taxable to all employees under Internal Revenue Service rules. |

(e)

| Includes costs of life insurance premiums and a gym allowance for all officers; financial and tax counseling services for Mr. Brandt; and home security costs for Mr. Niccol. |

GRANTS OF PLAN-BASED AWARDS IN

2015 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | ESTIMATED POSSIBLE PAYOUTS

UNDER NON-EQUITY INCENTIVE

PLAN AWARDS(1) | | | ESTIMATED POSSIBLE PAYOUTS

UNDER EQUITY INCENTIVE

PLAN AWARDS(2) | | | GRANT DATE

FAIR VALUE

OF STOCK

AWARDS(3) | |

| NAME | | GRANT

DATE | | AWARD DESCRIPTION | | THRESHOLD

($) | | | TARGET ($) | | | MAXIMUM ($) | | | THRESHOLD

(# shares) | | | TARGET (# shares) | | | MAXIMUM (# shares) | | |

| STEVE ELLS | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | n/a | | AIP | | $ | 0 | | | $ | 1,925,000 | | | $ | 3,927,000 | | | | | | | | | | | | | | | | | |

| | 2/20/15 | | Performance Shares | | | | | | | | | | | | | | | 7,444 | | | | 14,887 | | | | 29,774 | | | $ | 12,030,036 | |

| MONTY MORAN | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | n/a | | AIP | | $ | 0 | | | $ | 1,650,000 | | | $ | 3,366,000 | | | | | | | | | | | | | | | | | |

| | 2/20/15 | | Performance Shares | | | | | | | | | | | | | | | 7,444 | | | | 14,887 | | | | 29,774 | | | $ | 12,030,036 | |

| JACK HARTUNG | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | n/a | | AIP | | $ | 0 | | | $ | 637,500 | | | $ | 1,300,500 | | | | | | | | | | | | | | | | | |

| | 2/20/15 | | Performance Shares | | | | | | | | | | | | | | | 3,126 | | | | 6,252 | | | | 12,504 | | | $ | 5,052,179 | |

| MARK CRUMPACKER | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | n/a | | AIP | | $ | 0 | | | $ | 347,750 | | | $ | 709,410 | | | | | | | | | | | | | | | | | |

| | 2/20/15 | | Performance Shares | | | | | | | | | | | | | | | 2,233 | | | | 4,466 | | | | 8,932 | | | $ | 3,608,930 | |

| | Brian Niccol | | | AIP | | | — | | | $0 | | | $2,600,000 | | | $7,150,000 | | | | | | | | | | | | | | | | | | | | | | |

| | PSUs(5) | | | 2/9/23 | | | | | | | | | | | | 0 | | | 5,788 | | | 17,364 | | | | | | | | | | | | $9,300,795 | |

| | SOSARs(6) | | | 2/9/23 | | | | | | | | | | | | | | | | | | | | | | | | 11,983 | | | $1,606.91 | | | $6,200,364 | |

| | Jack Hartung | | | AIP | | | — | | | $0 | | | $951,500 | | | $2,616,625 | | | | | | | | | | | | | | | | | | | | | | |

| | PSUs(5) | | | 2/9/23 | | | | | | | | | | | | 0 | | | 2,054 | | | 6,162 | | | | | | | | | | | | $3,300,593 | |

| | SOSARs(6) | | | 2/9/23 | | | | | | | | | | | | | | | | | | | | | | | | 4,252 | | | $1,606.91 | | | $2,200,112 | |

| | Curt Garner | | | AIP | | | — | | | $0 | | | $780,000 | | | $2,145,000 | | | | | | | | | | | | | | | | | | | | | | |

| | PSUs(5) | | | 2/9/23 | | | | | | | | | | | | 0 | | | 1,867 | | | 5,601 | | | | | | | | | | | | $3,000,101 | |

| | SOSARs(6) | | | 2/9/23 | | | | | | | | | | | | | | | | | | | | | | | | 3,866 | | | $1,606.91 | | | $2,000,384 | |

| | Chris Brandt | | | AIP | | | — | | | $0 | | | $652,500 | | | $1,794,375 | | | | | | | | | | | | | | | | | | | | | | |

| | PSUs(5) | | | 2/9/23 | | | | | | | | | | | | 0 | | | 1,681 | | | 5,043 | | | | | | | | | | | | $2,701,216 | |

| | SOSARs(6) | | | 2/9/23 | | | | | | | | | | | | | | | | | | | | | | | | 1,740 | | | $1,606.91 | | | $900,328 | |

| | RSUs(6) | | | 2/9/23 | | | | | | | | | | | | | | | | | | | | | 561 | | | | | | | | | $901,477 | |

| | Scott Boatwright | | | AIP | | | — | | | $0 | | | $585,000 | | | $1,608,750 | | | | | | | | | | | | | | | | | | | | | | |

| | PSUs(5) | | | 2/9/23 | | | | | | | | | | | | 0 | | | 1,681 | | | 5,043 | | | | | | | | | | | | $2,701,216 | |

| | SOSARs(6) | | | 2/9/23 | | | | | | | | | | | | | | | | | | | | | | | | 1,740 | | | $1,606.91 | | | $900,328 | |

| | RSUs(6) | | | 2/9/23 | | | | | | | | | | | | | | | | | | | | | 561 | | | | | | | | | $901,477 | |

(1)

| Each executive officer was entitled toThe Compensation, People and Culture Committee approved the 2023 annual grants on February 7, 2023, with a cash award to be paid under our 2014 Cash Incentive Plan, although as a mattergrant date of practice the Compensation Committee exercises discretion to pay each executive officer a lesser amount determined under the AIP as described under “Compensation Discussion and Analysis – Components of Compensation – Annual Incentives.” Amounts under Threshold reflectFebruary 9, 2023. |

(2)

| The “Threshold” column reflects amounts that no payouts would be paid under the AIP if achievement against company targetseach executive officer achieved the plan goals at the minimum level required to receive any payout. The “Target” column reflects amounts that would be paid under the AIP if the performance goals under the AIP were sufficiently below target. Amounts under Target reflect the target AIP bonus, whicheach achieved at 100%. The “Maximum” column reflects amounts that would have beenbe paid to the executive officer if each of the company performance factor, team performance factor and individual performance factor under the AIP had been set at 100 percent. Amountsif the performance goals under Maximum reflect the AIP bonus which would have been payable had each of the company performance factor, team performance factor and individual performance factor beenwere achieved at the maximum level. Amounts in each column assume that the Compensation, People and Culture Committee does not utilize the food safety modifier to decrease the payout to any NEO by up to -20%. Actual AIP bonuses paid are reflected in the “Non-Equity Incentive Plan Compensation” column of the table labeled2023 Summary Compensation Table above. See “Compensation Discussion and Analysis – 2023 Compensation Program – Annual Incentive Plan” for further information regarding the AIP. |

(2)(3)

| The Performance ShareAll equity awards are denominatedshown in shares of common stock and were granted under the Chipotle Mexican Grill, Inc. 20112022 Stock Incentive Plan, as amended and restated.Plan. See “Terms of 2015 Equity-Based2023 Annual PSU Awards,” “Terms of 2023 Annual SOSAR Awards” and “Terms of 2023 Annual RSU Awards” below for a description of the vesting terms for the Performance SharesPSUs, SOSARs and RSUs granted during 2015. 2023. |

(4)

| See Note 68 to our audited consolidated financial statements for the year ended December 31, 2015,2023, which are included in our Annual Report on Form 10-K filed with the SEC on February 5, 2016,8, 2024, for descriptions of the methodologies and assumptions we used to value Performance Shareequity awards pursuant to FASB Topic 718. The grant date fair value of Performance Share awards is included in the “Stock Awards” column of the Summary Compensation Table above for each executive officer for 2015. |

(3)(5)

| See footnote (1)PSUs will vest to the Summary Compensation Table above.extent that the company’s three-year cumulative RCF dollars and total number of new restaurant openings over the 2023 through 2025 performance period equal or exceed the predetermined threshold performance level. |

(6)

| SOSAR and RSU awards vest 50% on the second anniversary and 50% on the third anniversary of the date of grant, subject to continued employment through the applicable vesting date. |

| | | | 2024 Proxy Statement 72 | | |

TermsTABLE OF CONTENTS

TERMS OF 2023 ANNUAL PSU AWARDS Annual PSUs granted to the executive officers in 2023 will vest only if and to the extent that the company’s three-year cumulative restaurant cash flow (RCF) dollars and total number of

2015 Performance Share AwardsVestingnew restaurant openings (NROs) over the 2023 through 2025 performance period equal or exceed the predetermined threshold performance level. The payout range for the PSUs is 0% to 300%, and PSUs will only be earned if the 3-year cumulative RCF Dollars are greater than $7.1 billion (90% weight) and/or if more than 730 total NROs occur over the performance period (10% weight). If the cumulative RCF dollars and/or the total NROs fall between two stated performance levels in the performance goal table, the payout of the Performance Share awards made in 2015percentage will be based on Chipotle’s relative performance versus our restaurant industry peer group in revenue growth, net income growth, and total shareholder return, with each performance measure to be weighted equally. The awards will pay out at the target number of shares set forth in the Grants of Plan-Based Awards for 2015 table, above, if our relative achievement versus the peer group, averaged across the three performance measures, is at the 65th percentile; will pay out at two times the target number of shares set forth in the table if our averaged relative percentile achievement versus the peer group is at or above the 90th percentile; and will pay out at one-half the target number of shares set forth below if our averaged relative percentile achievement versus the peer group is at the 35th percentile. Payout for achievement in between the 35th and 65th, and between the 65th and 90th, percentiles will be interpolated linearly between the threshold and target payout levels or target and maximum payout levels, as applicable. Averaged relative achievement versus the peer group below the 35th percentile will result in expiration of the awards with no payout. Performance will be calculated over the three year period beginning January 1, 2015 and ending December 31, 2017.determined using linear interpolation. Vesting and payout of each awardPSU is subject to the recipient’sexecutive officer’s continued employment through the vesting date subject to the potential pro-rata payout to the recipient or his estate(except in the event of termination of employment due to death disability or retirement,disability), and to potentialeach PSU may be paid out on an accelerated vestingbasis in the event of certain terminations within two yearsa change in control transaction and continued vesting (possibly on a pro-rata basis) upon retirement of the holder.

TERMS OF 2023 ANNUAL SOSAR AWARDS A SOSAR represents the right to acquire a specific number of shares of common stock at a pre-set price, which has value when the market price of the common stock at the time of exercise exceeds the exercise price. The exercise price of the SOSARs is equal to the closing price of our common stock on the date of grant. SOSARs vest 50% on the second anniversary and 50% on the third anniversary of the date of grant, subject to the executive’s continued employment, and have a seven-year term. SOSARs may continue to vest upon the holder’s retirement and may vest on an accelerated basis in the event of termination of employment due to death or disability, a qualifying termination of employment following a change in control, and upon completion of certain change in control transactions as describedin which the SOSARs are not replaced.

TERMS OF 2023 ANNUAL RSU AWARDS RSUs vest 50% on the second anniversary and 50% on the third anniversary of the date of grant, subject to the executive’s continued employment, and will settle in shares of common stock on a one-for-one basis. The RSUs may continue to vest upon the holder’s retirement and may vest on an accelerated basis in the

footnotesevent of termination of employment due to

death or disability, a qualifying termination of employment following a change in control, and upon completion of certain change in control transactions in which the

Equity Award Vesting table appearing belowRSUs are not replaced. | | | | 2024 Proxy Statement 73 | |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND2016 PROXY STATEMENT | | | 55 | |

| | |

Executive Officers and Compensation

(continued)

| |

|

TABLE OF CONTENTS

under “Potential Payments Upon Termination or Change-in-Control.” We filed the form of Performance Share Agreements for these grants as an exhibit to our Quarterly Report on Form 10-Q filed with the SEC on April 22, 2015.

OUTSTANDING EQUITY AWARDS AT

DECEMBER 31, 2015 | | | | | | | | | | | | | | | | | | | | | | | | |

| | | OPTION AWARDS | | | STOCK AWARDS | |

NAME | | NUMBER OF SECURITIES

UNDERLYING

UNEXERCISED

OPTIONS EXERCISABLE | | | NUMBER OF SECURITIES

UNDERLYING

UNEXERCISED

OPTIONS UNEXERCISABLE | | | OPTION

EXERCISE

PRICE | | | OPTION

EXPIRATION

DATE | | | EQUITY INCENTIVE

PLAN AWARDS:

NUMBER OF

UNEARNED

SHARES, UNITS OR OTHER RIGHTS

THAT HAVE NOT

VESTED | | | EQUITY INCENTIVE

PLAN AWARDS:

MARKET OR

PAYOUT VALUE

OF UNEARNED

SHARES, UNITS

OR OTHER RIGHTS

THAT HAVE NOT

VESTED | |

| STEVE ELLS | | | | | | | | | | | | | | | | | | | | | | | | |

| | | — | | | | 37,500 | (1) | | $ | 318.45 | | | | 2/7/2020 | | | | 5,000 | (6) | | $ | 2,399,250 | (7) |

| | | — | | | | 37,500 | (2) | | $ | 318.45 | | | | 2/7/2020 | | | | 7,444 | (8) | | $ | 3,572,003 | (7) |

| | | — | | | | 87,500 | (3) | | $ | 543.20 | | | | 2/3/2021 | | | | | | | | | |

| | | — | | | | 87,500 | (4) | | $ | 543.20 | | | | 2/3/2021 | | | | | | | | | |

| MONTY MORAN | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 40,000 | | | | — | | | $ | 371.63 | | | | 2/6/2019 | | | | 5,000 | (6) | | $ | 2,399,250 | (7) |

| | | 60,000 | | | | — | | | $ | 371.63 | | | | 2/6/2019 | | | | 7,444 | (8) | | $ | 3,572,003 | (7) |

| | | 37,500 | | | | 37,500 | (1) | | $ | 318.45 | | | | 2/7/2020 | | | | | | | | | |

| | | 37,500 | | | | 37,500 | (2) | | $ | 318.45 | | | | 2/7/2020 | | | | | | | | | |

| | | — | | | | 87,500 | (3) | | $ | 543.20 | | | | 2/3/2021 | | | | | | | | | |

| | | — | | | | 87,500 | (4) | | $ | 543.20 | | | | 2/3/2021 | | | | | | | | | |

| JACK HARTUNG | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 12,500 | | | | 12,500 | (1) | | $ | 318.45 | | | | 2/7/2020 | | | | 2,500 | (6) | | $ | 1,199,625 | (7) |

| | | 12,500 | | | | 12,500 | (2) | | $ | 318.45 | | | | 2/7/2020 | | | | 3,126 | (8) | | $ | 1,500,011 | (7) |

| | | — | | | | 30,000 | (3) | | $ | 543.20 | | | | 2/3/2021 | | | | | | | | | |

| | | — | | | | 30,000 | (4) | | $ | 543.20 | | | | 2/3/2021 | | | | | | | | | |

| MARK CRUMPACKER | | | | | | | | | | | | | | | | | | | | | | | | |

| | | — | | | | 4,000 | (1) | | $ | 318.45 | | | | 2/7/2020 | | | | 2,000 | (6) | | $ | 959,700 | (7) |

| | | — | | | | 4,000 | (2) | | $ | 318.45 | | | | 2/7/2020 | | | | 2,233 | (8) | | $ | 1,071,505 | (7) |

| | | — | | | | 2,000 | (5) | | $ | 365.80 | | | | 6/8/2020 | | | | | | | | | |

| | | — | | | | 15,000 | (3) | | $ | 543.20 | | | | 2/3/2021 | | | | | | | | | |

| | | — | | | | 15,000 | (4) | | $ | 543.20 | | | | 2/3/2021 | | | | | | | | | |

| | Brian Niccol | | | 3/5/2018 | | | 1,334 | | | — | | | $400.20 | | | 3/5/2025 | | | — | | | — | | | — | | | — | |

| | 2/8/2019 | | | 5,275 | | | — | | | $582.77 | | | 2/8/2026 | | | — | | | — | | | — | | | — | |

| | 2/6/2020 | | | 17,812 | | | — | | | $857.00 | | | 2/6/2027 | | | — | | | — | | | — | | | — | |

| | 2/4/2021 | | | 6,098 | | | 6,098 | | | $1,479.55 | | | 2/4/2028 | | | — | | | — | | | 13,531 | | | $30,944,856 | |

| | 2/10/2022 | | | — | | | 11,940 | | | $1,578.00 | | | 2/10/2029 | | | — | | | — | | | 5,134 | | | $11,741,253 | |

| | 2/9/2023 | | | — | | | 11,983 | | | $1,606.91 | | | 2/9/2030 | | | — | | | — | | | 17,364 | | | $39,710,773 | |

| | Jack Hartung | | | 2/8/2019 | | | 6,782 | | | — | | | $582.77 | | | 2/8/2026 | | | — | | | — | | | — | | | — | |

| | 2/6/2020 | | | 5,344 | | | — | | | $857.00 | | | 2/6/2027 | | | — | | | — | | | — | | | — | |

| | 2/4/2021 | | | 1,779 | | | 1,779 | | | $1,479.55 | | | 2/4/2028 | | | — | | | — | | | 3,948 | | | $9,028,918 | |

| | 2/10/2022 | | | — | | | 3,538 | | | $1,578.00 | | | 2/10/2029 | | | — | | | — | | | 1,521 | | | $3,478,466 | |

| | 2/9/2023 | | | — | | | 4,252 | | | $1,606.91 | | | 2/9/2030 | | | — | | | — | | | 6,162 | | | $14,092,248 | |

| | Curt Garner | | | 3/29/2018 | | | 5,384 | | | — | | | $355.42 | | | 3/29/2025 | | | — | | | — | | | — | | | — | |

| | 2/8/2019 | | | 6,782 | | | — | | | $582.77 | | | 2/8/2026 | | | — | | | — | | | — | | | — | |

| | 2/6/2020 | | | 5,344 | | | — | | | $857.00 | | | 2/6/2027 | | | — | | | — | | | — | | | — | |

| | 2/4/2021 | | | 1,779 | | | 1,779 | | | $1,479.55 | | | 2/4/2028 | | | — | | | — | | | 3,948 | | | $9,028,918 | |

| | 2/10/2022 | | | — | | | 3,538 | | | $1,578.00 | | | 2/10/2029 | | | — | | | — | | | 1,521 | | | $3,478,466 | |

| | 2/9/2023 | | | — | | | 3,866 | | | $1,606.91 | | | 2/9/2030 | | | — | | | — | | | 5,601 | | | $12,809,263 | |

| | Chris Brandt | | | 2/6/2020 | | | 4,453 | | | — | | | $857.00 | | | 2/6/2027 | | | — | | | — | | | — | | | — | |

| | 2/4/2021 | | | 1,525 | | | 1,524 | | | $1,479.55 | | | 2/4/2028 | | | — | | | — | | | 3,384 | | | $7,739,073 | |

| | 2/10/2022 | | | — | | | 3,273 | | | $1,578.00 | | | 2/10/2029 | | | — | | | — | | | 1,407 | | | $3,217,753 | |

| | 2/9/2023 | | | — | | | 1,740 | | | $1,606.91 | | | 2/9/2030 | | | 561 | | | $1,282,985 | | | 5,043 | | | $11,533,139 | |

| | Scott Boatwright | | | 2/4/2021 | | | 1,652 | | | 1,652 | | | $1,479.55 | | | 2/4/2028 | | | — | | | — | | | 3,665 | | | $8,381,708 | |

| | 2/10/2022 | | | — | | | 3,273 | | | $1,578.00 | | | 2/10/2029 | | | — | | | — | | | 1,407 | | | $3,217,753 | |

| | 2/9/2023 | | | — | | | 1,740 | | | $1,606.91 | | | 2/9/2030 | | | 561 | | | $1,282,985 | | | 5,043 | | | $11,533,139 | |

(1)

| These SOSARs which wereand RSUs vest ratably on the second and third anniversary of the grant date, subject to time-basedcontinued employment through the applicable vesting only, vested in full on February 7, 2016.date. |

(2)

| Vesting of these Performance SOSARs, is contingent upon our achievement of stated levels of cumulative adjusted cash flow from operations prior to the fifth fiscal year-end following the award date, with vesting to occur upon certification of the satisfaction of the performance criteria by the Compensation Committee and no earlier than expiration of the time-based vesting requirement on February 7, 2016. The performance criteria for these awards were satisfied as of December 31, 2015, and accordingly, following February 7, 2016, vesting is subject only to certification by the Compensation Committee of achievement of the performance criteria. Vesting of these Performance SOSARs may accelerate as described in the footnotes to the table below under “Potential Payments Upon Termination or Change-in-Control.” |

(3) | These SOSARs are subject to time-based vesting; one-half of the awards vested on February 3, 2016. |

(4) | Vesting of these Performance SOSARs is contingent upon our achievement of stated levels of cumulative adjusted cash flow from operations prior to the fourth and fifth fiscal year-ends following the award date with vesting to occur no sooner than February 3, 2016 and 2017 (with half of each Performance SOSAR subject to each such time-based vesting date). The performance criteria for the first tranche of these awards were satisfied as of December 31, 2015, and accordingly, following February 3, 2016, vesting of one-half of the awards is subject only to certification by the Compensation Committee of achievement of the performance criteria. Vesting of these Performance SOSARs may accelerate as described in the footnotes to the table below under “Potential Payments Upon Termination or Change-in-Control.” |

(5) | These SOSARs will vest on June 8, 2016, subject to potential accelerated vesting as described in the footnotes to the table below under “Potential Payments Upon Termination or Change-in-Control.” |

(6) | Represents shares issuable under 2013 performance share awards, assuming achievement at the threshold level of cumulative adjusted cash flow from operations, subject to certain adjustments for stock-based compensation expense and for one-time or unusual items, through September 30, 2016. |

(7) | BasedCalculated based on the closing stock price of our common stock on December 31, 201529, 2023 of $479.85$2,286.96 per share. |

(8)(3)

| Represents shares issuable under 2015Unless otherwise indicated, PSUs vest if and to the extent that the performance share awards, assuming achievementtargets are met at the end of the three-year performance period, subject to continued employment. For the 2021 PSUs, which vested on February 15, 2024, the number of shares in the table reflect shares earned based on actual achievement of the performance objectives. For the 2022 PSUs, which are scheduled to vest on February 15, 2025, the number of shares in the table reflect payout at target achievement level since performance through the completed years of the performance period exceeded threshold level. Thelevels. For the 2023 PSUs, which are scheduled to vest on February 15, 2026, the number of shares in the table reflect payout at maximum achievement level since performance termsthrough the completed years of the performance period exceeded target levels. Actual achievement of the performance objectives for the 20152022 PSUs and 2023 PSUs may vary from the achievement reflected in the table based on company performance share awards are described above under “—Termsover the remainder of 2015 Performance Share Awards.”the performance period. |

| | | |

56 | 2024 Proxy Statement 74 | NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND2016 PROXY STATEMENT | |

| | |

Executive Officers and Compensation

(continued)

| |

|

TABLE OF CONTENTS

OPTION EXERCISES AND STOCK VESTED IN

2015The following table provides summary information about SOSARs exercised by our executive officers during 2015. No full-value shares of stock vested during 2015.

| | | | | | | | |

| | | OPTION AWARDS | |

| NAME | | NUMBER OF SHARES ACQUIRED ON EXERCISE | | | VALUE REALIZED

ON EXERCISE(1) | |

Steve Ells | | | 150,000 | | | $ | 46,594,735 | |

Monty Moran | | | 270,000 | | | $ | 107,808,576 | |

Jack Hartung | | | 75,000 | | | $ | 27,544,397 | |

Mark Crumpacker | | | 18,000 | | | $ | 5,330,771 | |

| | Brian Niccol | | | 23,908 | | | $37,043,365 | | | 16,535 | | | $27,555,009 | |

| | Jack Hartung | | | — | | | — | | | 6,661 | | | $11,196,218 | |

| | Curt Garner | | | 1,250 | | | $2,190,945 | | | 6,661 | | | $11,196,218 | |

| | Chris Brandt | | | 5,304 | | | $6,854,765 | | | 6,066 | | | $10,217,729 | |

| | Scott Boatwright | | | 2,449 | | | $2,906,197 | | | 6,364 | | | $10,707,796 | |

(1)

| BasedReflects the number of shares of Chipotle common stock acquired on exercise of SOSARs or the vesting of RSUs and PSUs. |

(2)

| Equals the number of underlying shares exercised multiplied by the difference between the market value of common stock on the amount by whichdate of exercise and the price of our common stock used to compute the exercise proceeds exceeded the base price of the SOSARs. |

(3)

| Equals the closing price the Chipotle’s common stock on the vesting date multiplied by the number of shares vested. |

NON-QUALIFIEDNONQUALIFIED DEFERRED COMPENSATION FOR 2015

2023